It helps you make progress toward your goals at any level that makes sense for you.Įxperts recommend trying to set aside 10 to 20% of your income for your goals, but paying even $50 extra on a credit card every month can make a big difference toward reducing that debt.

If you’re just getting started and your income is higher than your monthly expenses, this is a great way to ease into a personal monthly budget. Then set aside enough to cover your fixed bills, and spend the rest on whatever you want. The Goals-First Personal Budget TemplateĪ goals-first personal budget is just what it sounds like: put some money aside for your goals first, every time you get paid.

#CREATING A PERSONAL BUDGET ARTICLE HOW TO#

How to Choose a Goal for Your Personal Monthly Budget If you don’t pause them, you’ll need to account for them in your budget. It’s important to add these up because they’re charged automatically every month. Also known as discretionary, variable, or flexible expenses, these are the things you pay for every month but don’t technically have to have. Add up your monthly “nice-to-have” expensesįinally, you’ll want to add up your “nice-to-have” subscriptions and other expenses.

If you add everything up and your expenses are higher than your income, don’t give up! A simple budget is one of the best tools you can use to turn your personal finances around.Īfter you create your budget, this guide will walk you through some helpful tips for making ends meet and even getting ahead. These are also known as “non-discretionary expenses” or “fixed expenses.”Īs you add up these expenses, be sure to think about things you might only pay for once every three months, every six months, or even every year.įor example, if you save money by paying your entire car insurance premium every 6 months, remember to include one-sixth of that amount in your monthly expenses. No matter how much you love Netflix, you could pause it for a month if you had to.) In other words, “have-to” bills include anything you can’t decide to skip. Fuel for your car (or other transportation).Your monthly “have-to” bills are things like: That’s your average monthly take-home pay. Add those things together, and then divide by 3.If you have cash you don’t deposit, estimate an average week and multiply that by 13.Add up your bank deposits for the last 3 months.No matter what your personal situation is, even if your income changes from month to month, you can still work out a good starting point for your monthly take-home pay: Do you get paid every week or every 2 weeks?.Do you have a side gig that brings in some extra cash?.

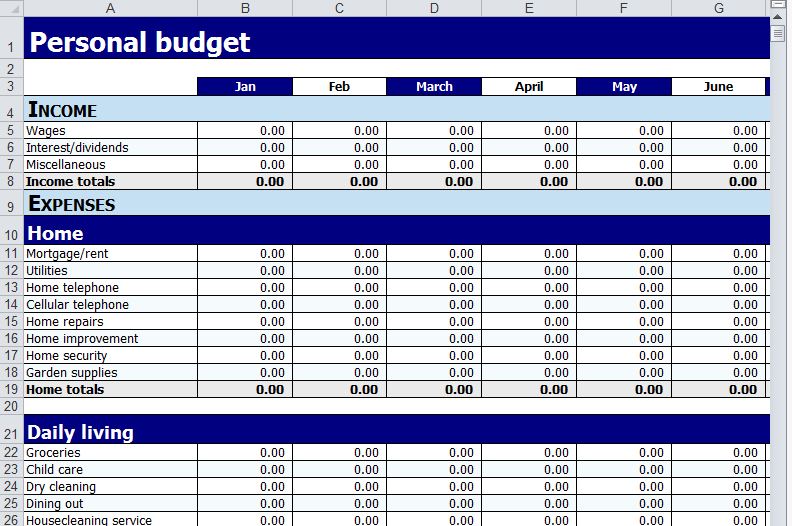

Do you work shifts that change weekly or monthly?.Whatever you bring home each month after taxes and other paycheck deductions is your monthly take-home pay.įor everyone else, your monthly income might move around a bit: If you’re lucky enough to get paid once a month for working one job with a steady paycheck, this step is simple. The first number you need for your personal monthly budget is your monthly take-home pay. How to Get Started with a Simple Personal Budget Step 1. This guide will walk you through 4 great approaches to personal budgeting, all of which are designed to keep your budget flexible-so you can handle anything life throws at you while keeping your personal monthly budget on track. You can track your budget in a spreadsheet or use a personal budget app to stay on top of your money.įortunately, there are a few basic approaches to personal budgeting that make it much easier to get started, and they all begin with the same first steps. You can keep things at a high level or you can break your spending down into personal budget categories.

Creating a simple personal budget always comes down to one thing: keeping your total monthly expenses below your monthly take-home pay.īut there are about as many ways to do that as there are people on the planet.

0 kommentar(er)

0 kommentar(er)